How to Create a Robust Trading Plan with MetaTrader 4

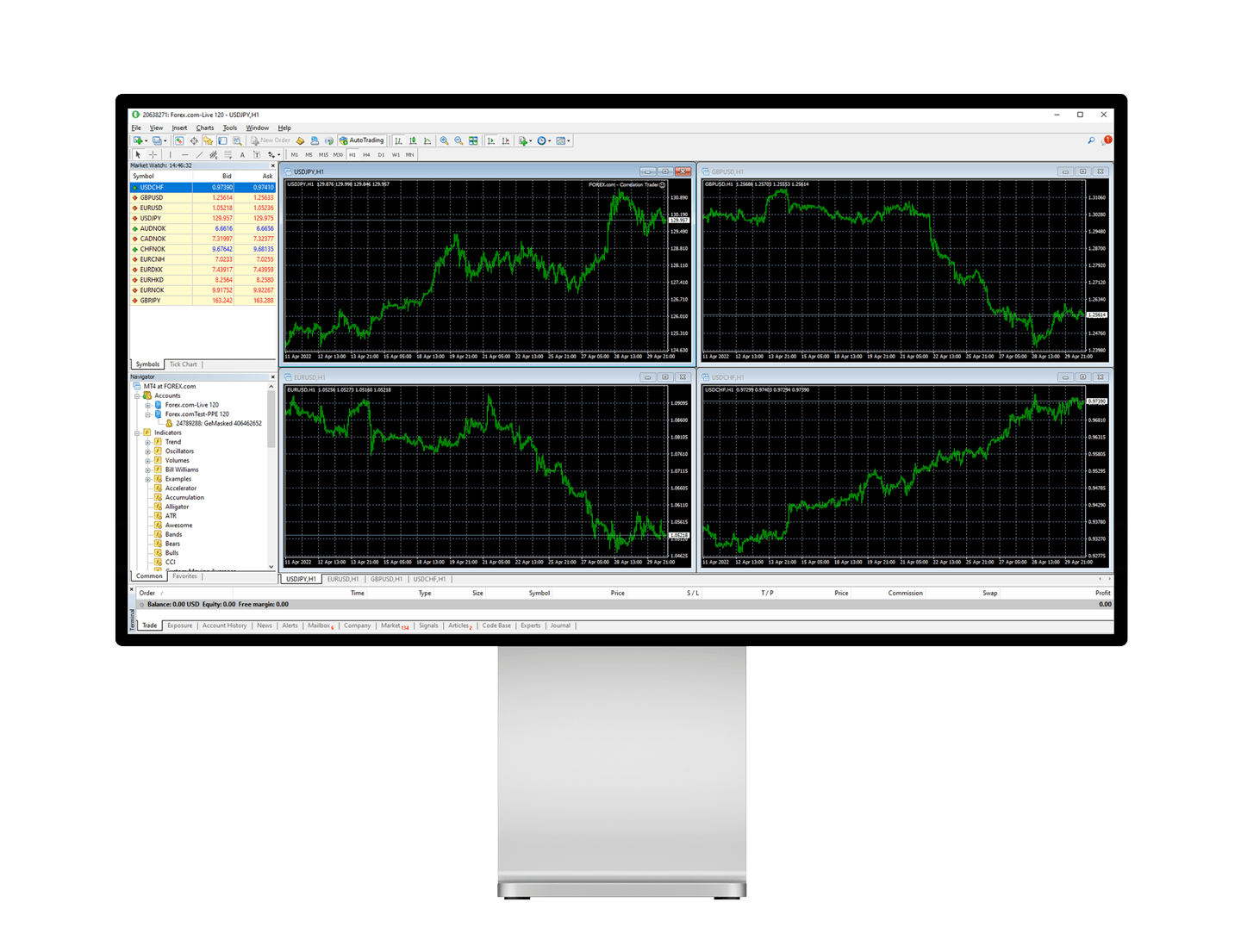

Trading can be a highly rewarding endeavor, but without a solid plan, it can also lead to significant losses. A robust trading plan acts as your roadmap, guiding your decisions and helping you stay disciplined in the often unpredictable world of financial markets. MetaTrader 4 (MT4) is one of the most popular trading platforms, offering an array of tools that can aid in building a comprehensive trading strategy. Here’s how you can create a robust trading plan using metatrader 4 for windows.

Define Your Trading Goals

Before diving into the technical aspects, it’s crucial to outline what you aim to achieve. Are you looking for short-term gains or long-term investments? Understanding your financial goals will help shape the rest of your trading plan.

Choose Your Market

MetaTrader 4 supports various financial instruments, including forex, commodities, and indices. Decide which market you want to focus on based on your expertise and interest. Familiarize yourself with the specific market conditions, trading hours, and volatility.

Establish Risk Management Rules

Risk management is a cornerstone of successful trading. Determine how much capital you are willing to risk per trade. A common rule of thumb is to never risk more than 1-2% of your trading account on a single trade. Use MT4’s built-in tools to set Stop-Loss and Take-Profit levels to manage your risk effectively.

Develop Entry and Exit Strategies

Define clear criteria for entering and exiting trades. This could be based on technical indicators, chart patterns, or fundamental analysis. MetaTrader 4 offers a wide range of tools like Moving Averages, RSI, and MACD to help you identify optimal entry and exit points. Backtest your strategies using MT4’s historical data to ensure they are effective.

Keep a Trading Journal

Documenting your trades is essential for continuous improvement. Use MT4’s built-in features to keep a detailed trading journal. Record the reasons for entering a trade, the outcome, and any lessons learned. Analyzing your past trades can provide valuable insights and help refine your trading plan.

Monitor and Adjust

The financial markets are dynamic, and so should be your trading plan. Regularly review your performance and adjust your strategies as needed. MetaTrader 4 allows you to customize your trading environment and adapt to changing market conditions.

Conclusion

Creating a robust trading plan with MetaTrader 4 involves setting clear goals, managing risk, developing entry and exit strategies, and continuously monitoring your performance. By leveraging the powerful tools offered by MT4, you can enhance your trading discipline and increase your chances of success in the financial markets.